Advocacy

Every entrepreneur deserves access to responsible, affordable capital that will help their business thrive, not force them out of business. The Responsible Business Lending Coalition advocates for policies that enshrine the principles of the Small Business Borrowers' Bill of Rights into law. Signatories and Endorsers of the Small Business Borrowers’ Bill of Rights do not necessarily endorse the Coalition’s policy recommendations, but they are encouraged to sign onto specific proposals and support advocacy efforts aimed to enshrine the Rights into law.

To learn how you can join the small business financial protection movement, please contact [email protected]! Stay up-to-date on our latest policy work by following us on Twitter @TheRBLC.

To learn how you can join the small business financial protection movement, please contact [email protected]! Stay up-to-date on our latest policy work by following us on Twitter @TheRBLC.

Federal Advocacy

The RBLC has brought together for-profit and nonprofit finance providers, advocacy and civil rights groups, and small businesses to promote responsible small business financing.

Right to Transparent Pricing Pricing and Terms

Because of loopholes in current laws, financing providers are targeting business owners with harmful debt products with annual percentage rates (APRs) of as high as 350% or more, without ever disclosing these rates to them. Together with our partners, the RBLC is working to advance legislation that ensures small business owners seeking capital have access to clear, honest information about pricing so they can compare financial products and choose the best option for their business.

Right to Transparent Pricing Pricing and Terms

Because of loopholes in current laws, financing providers are targeting business owners with harmful debt products with annual percentage rates (APRs) of as high as 350% or more, without ever disclosing these rates to them. Together with our partners, the RBLC is working to advance legislation that ensures small business owners seeking capital have access to clear, honest information about pricing so they can compare financial products and choose the best option for their business.

- Featured Resource: Small Business Financing Disclosure Act Two-Pager

- Featured Resource: Section-by-Section Summary of the Small Business Financing Disclosure Act

- Featured Resource: Fact Sheet on Why APR is Essential to Small Business Financing Transparency

Right to Inclusive Credit Access

No matter who they are, where they live, or how much they make, every business owner deserves access to responsible capital that will enable them to grow their venture. RBLC supports and has provided recommendations during the Consumer Financial Protection Bureau’s (CFPB) rulemaking process to implement Section 1071 of the Dodd-Frank Wall Street Reform and Consumer Protection Act. Implementing Section 1071 will address the absence of comprehensive information about small business financing and improve access to capital for small business owners, especially those in underserved areas. Importantly, the rule will require non-bank finance providers, as well as banks, to report data on credit applications, decisions, and terms. By increasing transparency in the small business lending space, implementation of Section 1071 will facilitate better financing practices and better outcomes for America's small businesses.

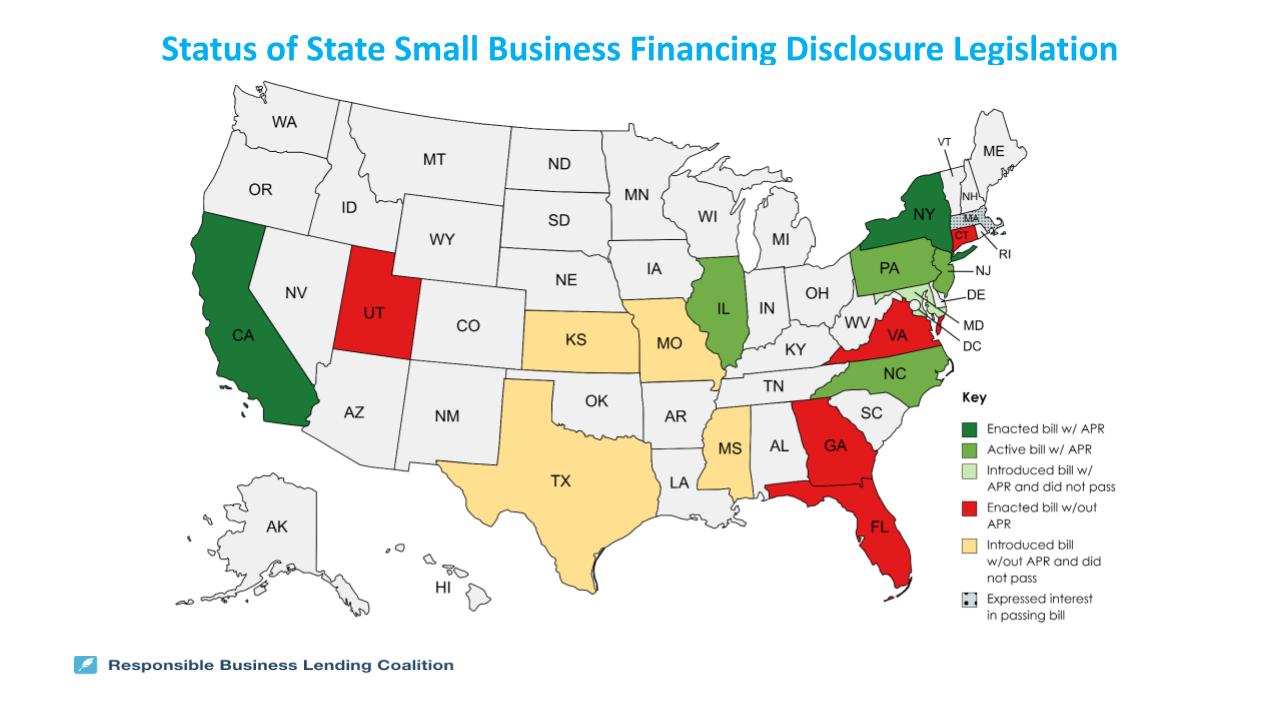

State Advocacy

In the absence of federal legislation to protect small business owners, state legislatures are taking the lead in addressing the issue. If you are interested in engaging in our state-level advocacy efforts, reach out to [email protected].